1,800,000+ families protected

Get life insurance in 10 minutes

NO MEDICAL EXAMS • FAST PAYOUT

1,800,000+ families protected

Get life insurance in 10 minutes

NO MEDICAL EXAMS • FAST PAYOUT

The #1 no-medical-exam, instant life insurance website

Get covered in 10 minutes

Compare plans and apply in minutes. No paperwork or phone calls.

Up to $3 million in coverage

Choose the coverage amount that fits your needs and budget.

Your best price from multiple carriers

Compare rates from top insurers so you get the best rate.

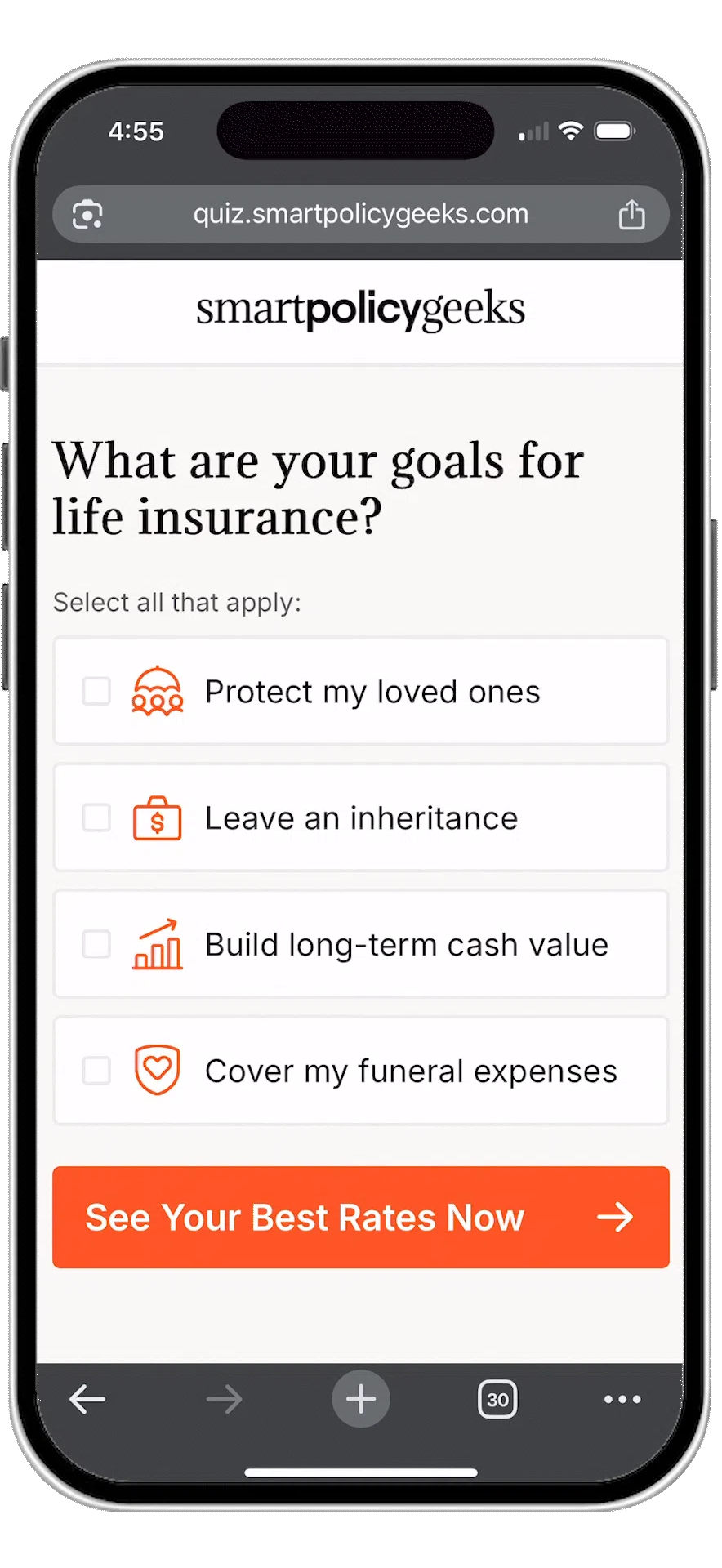

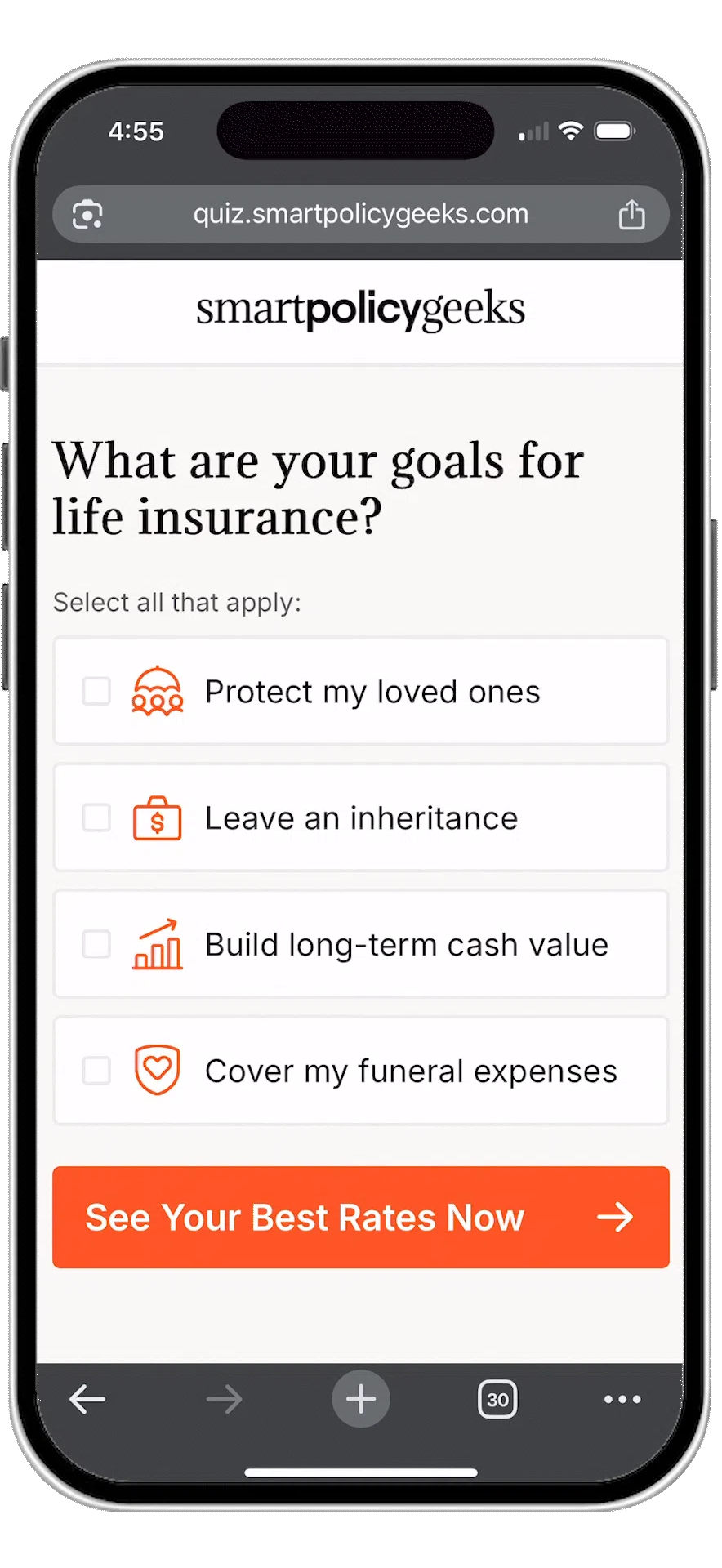

How it works:

We calculate your rate in real time, so you can get covered in 10 minutes

Step 1: Take our free quiz (no med exam)

Step 2: Get matched with your best rates

Step 3: Activate your coverage instantly

How it works:

We calculate your rate in real time, so you can get covered in 10 minutes

Step 1: Take our free quiz (no med exam)

Step 2: Get matched with your best rates

Step 3: Activate your coverage instantly

Life insurance made easy

See how SmartPolicyGeeks is changing the way people buy life insurance

Lock in your rate before your next birthday

Over 40 years old? Your life insurance price will increase 10% every 6 months you wait to start coverage. With SmartPolicyGeeks, getting covered only takes 10 minutes.

Lock in your rate before your next birthday

Over 40 years old? Your life insurance price will increase 10% every 6 months you wait to start coverage. With SmartPolicyGeeks, getting covered only takes 10 minutes.

FAQ

What does life insurance cover?

It can help cover some of life’s biggest expenses, like a home mortgage, debt, your children’s college tuition, and it can also replace lost income. Your policy can also help cover everyday expenses—anything your beneficiaries need, really. Ultimately, it’s up to them to decide how to use the payout. Click here to find your best life insurance rates.

Who is eligible to apply?

Age: All U.S. citizens and permanent residents ages of 20-85 can apply for coverage. If you’re 65 and under, you can own term coverage until age 80. If you are over 65, a guaranteed issue whole life insurance policy might be an easy way for you to get coverage quickly. You can start shopping here.

How much insurance do I need?

A common and easy way to come up with a coverage estimate is to multiply your annual income by 10. Another way is to calculate your long-term financial obligations and then subtract your assets. The remainder is the gap that life insurance needs to fill. It can be difficult to know what to include in your calculations, so we created a life insurance calculator to help you determine your coverage needs.

What makes SmartPolicyGeeks different?

We’ve built an industry-leading product that is transforming how people apply for life insurance. Our proprietary underwriting engine digitally assigns each customer to the appropriate product so applicants can get the coverage that best fits their unique needs as fast as possible. Check your final, approved rates in a matter of minutes and get covered today.

Is it cheaper to buy insurance through SmartPolicyGeeks?

Insurance rates are regulated by law, which means that no company, broker, or agent can offer you a discount on a policy. That doesn't mean you can't find ways to save money, though! Each insurer calculates risk differently, and they all strive to offer policies at competitive prices. That's why SmartPolicyGeeks helps you compare quotes from multiple companies in one place: to make it easy to spot potential savings.